I don’t know if you have noticed but by the end the week there was a theme in the media. The narrative was something like “this week marked a great recovery in oil prices”. Indeed, from the opening on Monday the WTI futures are up 20% on the front mont. The week closed just below $20 per barrel.

Is it really a good reason to celebrate though?

I remember the OPEC+ meeting just a few weeks ago. The plan was to announce historic levels of production cuts. And the anticipation of the news drove WTI to rally by 25% from $20 up to $25. In the mainstream media that was also treated as the end of the problem with oil prices…

But only a few days later the WTI May delivery traded negative!

So what is driving the rally this week? Is it really time to get long crude oil?

On the face of it the driving force of this rally is the following narrative: storage space issue is not as big of a problem as what we thought.

Two reasons why people think that:

The EIA inventory report shows a smaller build than expected.

Steve Mnuchin hinted at making US Strategic Petroleum Reserve storage capacity available for commercial purpose.

I don’t know if it’s only me but it doesn’t look like those news should drive any significant rally.

About Mnuchin comment honestly there is only so far you can trust the federal government on that. Words are cheap, making things happen is much harder. There seem to be only about 70M to 80M free storage capacity from the SPR that could be used for commercial purpose. That’s not bad. This is as much as Cushing. But you’ll need to move oil in those SPR storage tanks. And the logistics of that could take weeks to be in place. That is if the government follows through after the announcement…

I’m not holding my breath for that.

Now let’s look at the EIA inventory report. For the US as a whole:

Actual build of +9M barrels.

This is a 2 σ move.

It is much lower than the previous weeks for sure. But while it is not an outlier it is still on the high range of the historical distribution.

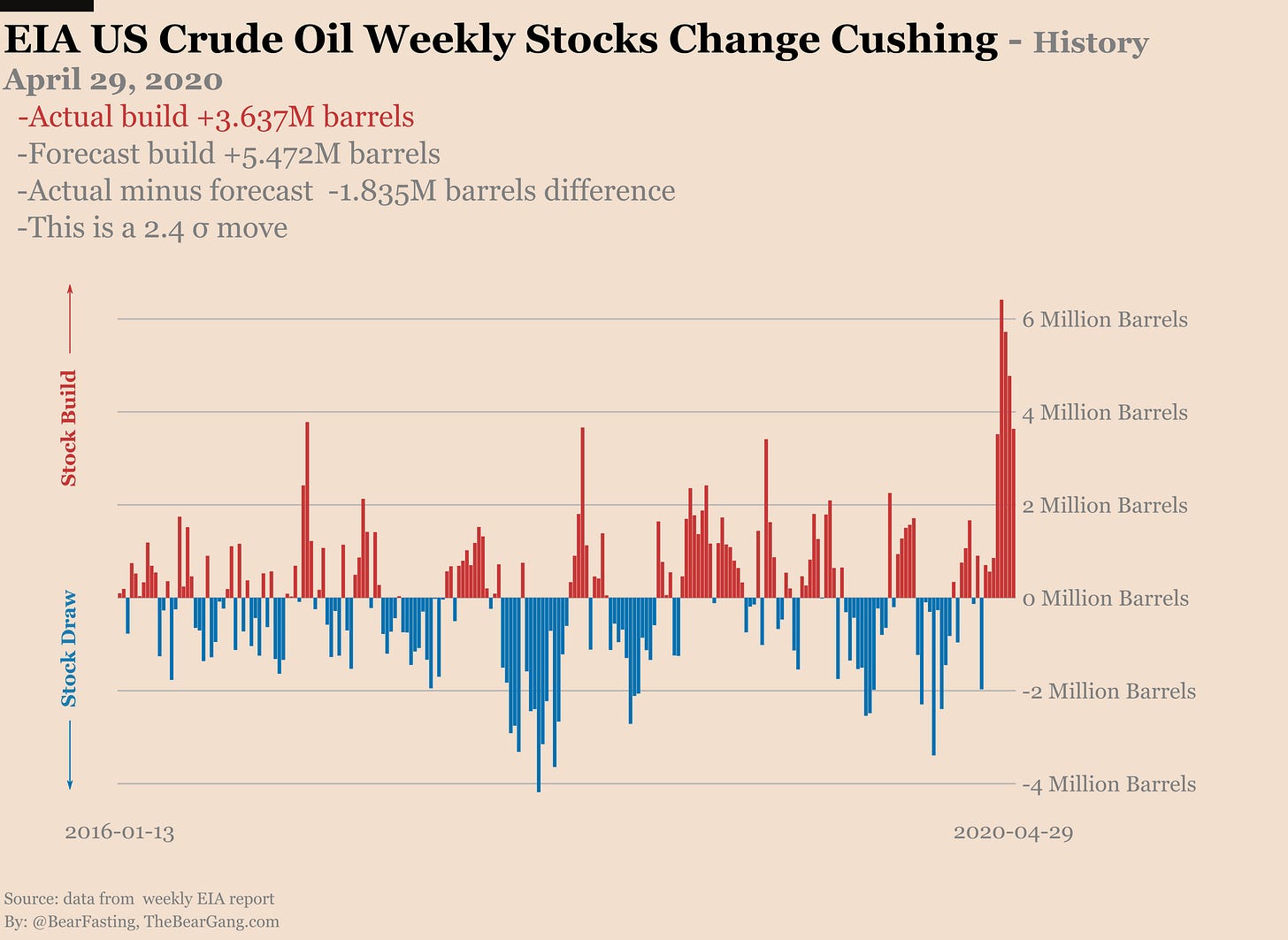

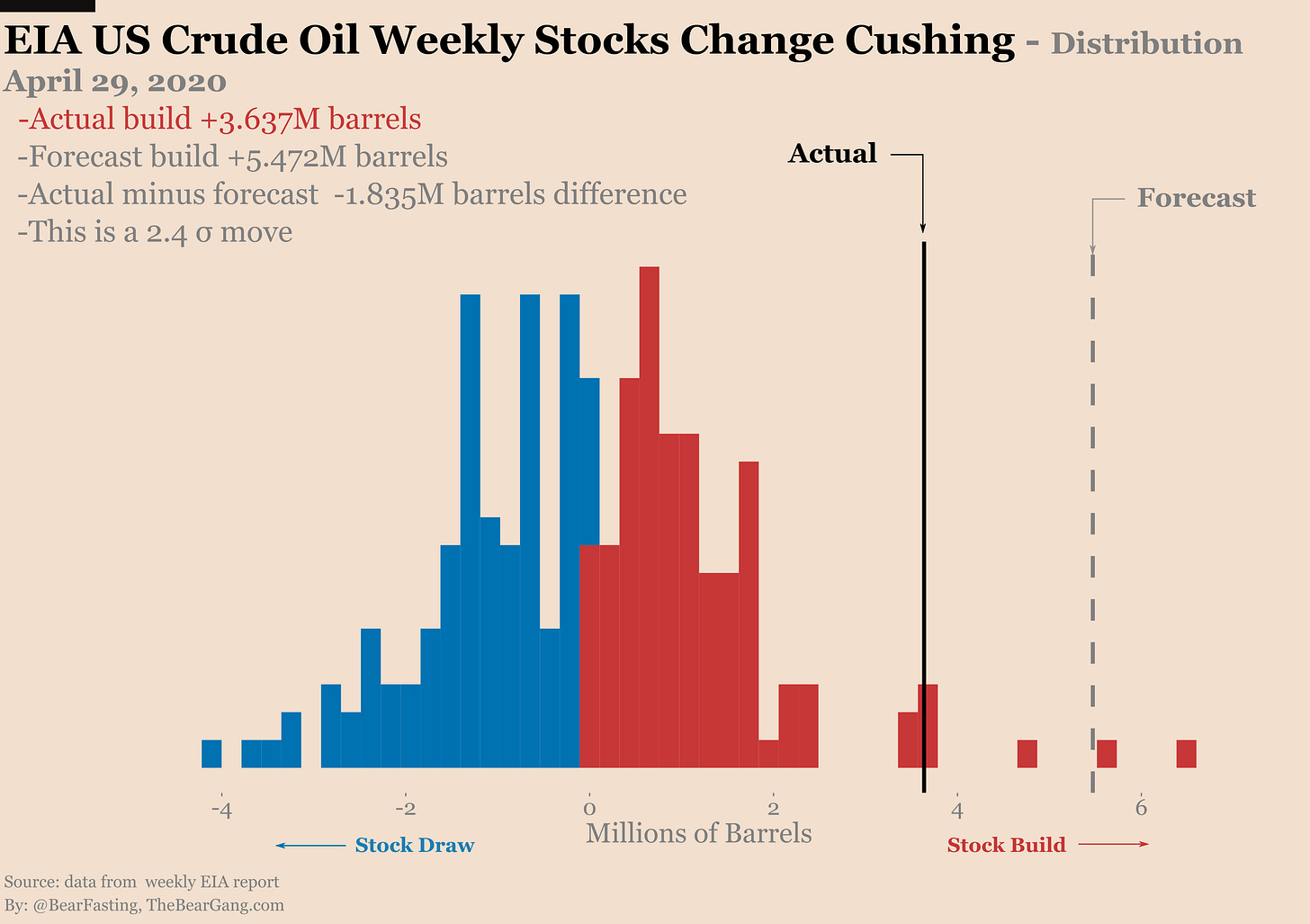

In Cushing the story is the same:

Actual build of +3.6M barrels.

Expected was +5.5M barrels.

This is a 2.4 σ move.

So not as high as the previous weeks but still very high historically speaking.

This has been interpreted as a great news. The reasoning is, if we keep getting smaller builds then Cushing will never get full. So there is actually no storage problem! Okay…

What about another way of looking at that?

Let me try: the storage capacity is getting so small that there is no way we keep getting large inventory build numbers. If there is only 10 million barrels of capacity left in my tank I won’t be getting a 15 million build…

The latest Cushing inventories data from April 24 is showing that about 85% of the storage capacity is used. Give it a couple more weeks, even with lower builds and we’ll be back to the historical max of close to 70M barrels stored there.

Then you have to account for two things:

For operational reasons you will not get 100% of the capacity used. Some tanks need to be kept empty for the facilities to have some margin of safety and to help with the flow of products.

The news of Cushing reaching max capacity would be a bad headline for big oil producers. So it might be cheaper for them to just lease tanks in Cushing to leave them empty than get oil prices to fall further.

So while we get closer and closer the the 70M barrels mark you’d expect the builds to get smaller BECAUSE of the capacity constraints. That does not sound like a particularly good news to me. The oil that is produced still has to go somewhere.

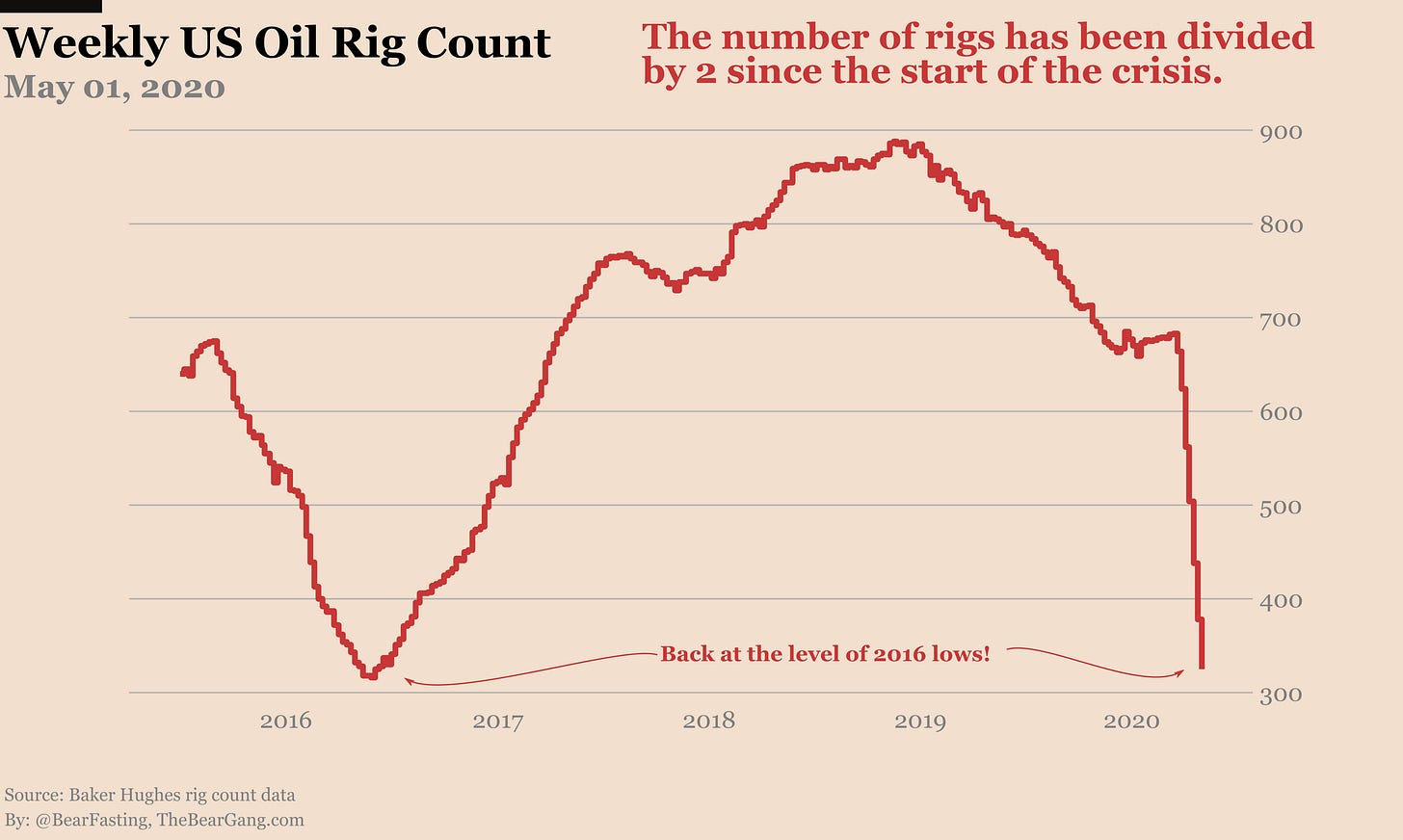

In terms of production the US oil rigs count has been decimated by the coronavirus pandemic. We are 50% down since the start of the pandemic. This week it stopped just above 300 rigs testing the lows last seen in the year 2016.

The landscape of the US oil production is likely to be different after all that is settled. Many small producers will go bankrupt. Power will be concentrated in fewer hands.

Completely closing down oil wells can be a costly business. Especially for shale oil where you lose on big time in performance when you have to shut-in and re-open the wells. A lot of producers probably went through the following steps to try to stay in business:

Continue business as usual hoping it won’t last.

Reduce production to combat oversupply.

Bring down production to the minimum level that guarantees the wells are safe to operate.

Shut-in the wells as there is no available storage and no buyers.

Since completely closing an oil well is expensive you can expect oil producers to try to delay this as much as possible. That’s why the production is not falling faster.

We are moving towards 12M barrels per day according to the EIA report while demand has dropped significantly more than that.

But there must be a point where there is no other way than shutting-in the wells and that will have an impact on the production and the producers.

So this week prices are up. And looking at the term structure the spread is lower on the front month. The curve is still steep and still in super contango. Up to January 2021 we have spreads of more than $0.5 which signals continued issue with demand and storage.

A report by the International Energy Agency is forecasting a decline in oil demand of 6% for 2020. This is a forecast is based on economies starting to reopen around the world and an expectation of the global supply chain to be restored before the end of the year.

Things that are not considered in this forecast:

A potential second wave of coronavirus.

A continued global financial crisis despite the world economies reopening.

A move towards a less global but more resilient economy that would shift global oil demand.

So no I’m not bullish on oil right now. It is too early to evaluate demand destruction over the long run.

The way things could play out in the following weeks:

As we get lower inventory build numbers WTI will find more reasons to rally.

That will last until storage capacity is virtually full and everybody starts to worry about physical delivery.

Let’s see how that plays out.

In the meantime if you liked this article please subscribe and share!